You have all heard the term “volume buying”, and at Feed Partners this is essentially the core of what we do. It is a simple concept to understand. You buy more volume; you get a better price. This is easy if you are buying for one entity, however, this can be a hard concept to implement when there are several producers involved. Over the past five years we have worked to master volume buying of amino acids, vitamins, trace minerals and other micro ingredients. We have figured out the nuances of vendors, packaging types (bags, totes, bulk) and logistics for all our procurement partners. With ever changing dynamics in the world market, pooling volume can be challenging to have the best price 100% of the time for 100% of our partners. In addition to a better price, there are other benefits to volume buying that aren’t typically talked about. These include a high-quality stable supply, forward contracting, and adjustable logistics to name a few.

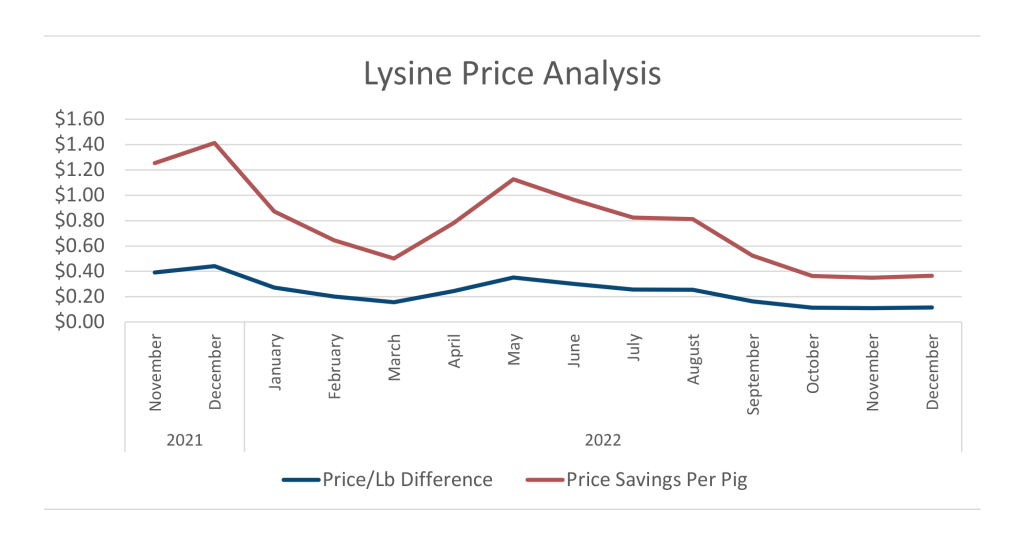

To help visualize how volume buying amino acids results increased dollars in the producers pocket, the graph above looks at the price per pound difference of lysine between our purchase price and the spot market price over a 12-month period. Depending on the month, the difference in price ranged from $0.44/lb at the high to $0.11/lb at the low. On a per pig basis this can range from an added $1.41 to $0.36/pig in feed cost when purchasing lysine on the spot market. On average, Feed Partners is able to save the producer $0.84/pig on just lysine from volume buying!

As we have looked to expand our volume pricing model to other areas, Feed Partners is now helping farmers with commodity purchasing of soybean meal and DDGS. Similar to our micro ingredient purchasing, we work to group individual producers purchasing activities together. When we can accumulate multiple small purchases across our producers into one large single transaction, this provides savings to all. These savings are realized by reducing transactions with suppliers, negotiating favorable terms, and most importantly providing consistent, reliable business to these processing groups.

When it comes to purchasing commodities, there are a few key areas where value can be captured:

Personnel – In the bulk commodity space, there is often high staff turnover in staff with merchandisers moving every 12-24 months. During their short tenure, developing relationships and understanding the needs of individual customers is challenging to grasp. At Pipestone, we plan to be the intermediary to these changes and ensure a transparent and consistent purchasing process for our producers.

Quality Product – While most buyers of goods know the general specifications that they are looking for, quality control and review is often “lost” after the purchase and delivery, especially in commodities. We intend to routinely sample ingredients to ensure deliveries match our purchasing expectations. With an open line of communication to our nutritionists, we can customize soybean meal and distiller nutrient analysis by supplier, which will improve accuracy and economics of diet formulation.

Delivery – In today’s transportation world, getting product shipped on time and as ordered is challenging to say the least. Lack of employees and ownership, and competing freight often put bulk commodities on the lower end of the priority list for delivery. By having a pooled, larger base of product, we can be moved higher up the priority list and ensure that transportation challenges are minimized, and producers receive product when expected.

Our efforts are proving that there are efficiencies to be had in bulk commodities. We are seeing incremental savings on product and verifying quality as we continue to develop this market. Our savings and improvements will continue to increase as we add additional producer volume. As you review your purchasing activity in the start of a new year, please reach out to our team to discuss how to participate in any of our “volume buying” opportunities.