With breakeven pressures lifted, now is the perfect time to step back from working in your business and focus on working on it—making strategic plans today to future-proof your farm and secure long-term success. As you reflect on the last 20 years in your agricultural business, you saw commodity prices that were high and low, profits that were positive and negative, and production trends that came and went. During that longer period, you likely noticed that your business changed, pivoted, and evolved to succeed. You probably weren’t doing the same things at the end of the 20 years as you were at the beginning.

During the difficult times, some farm managers decided to hunker down, go back to the basics and do things really well. Meanwhile, other farm managers used difficult times to evaluate their landscape and pivot toward opportunities. And, some did both.

If you are a manager who hunkers down and says, “the main thing is the main thing” and won’t be distracted by outside forces, you are confident that your playbook has stood the test of time. So, you go back to the playbook and execute your traditional offense and defense to perfection. I call this survival mode. At the same time, your peers are surveying the field for opportunities to change their business.

Generally, what sets these two manager profiles apart is how well they have prepared for the difficult times by building their working capital and equity positions. Consistent discipline to manage, measure and continually improve the business’ processes and results is important in creating financial preparedness. But, it’s not the only thing. There is a difference between doing things right and doing the right things. Businesses that have the good fortune to take a moment to survey the field during difficult times are often also doing the right things.

Integration or Diversification?

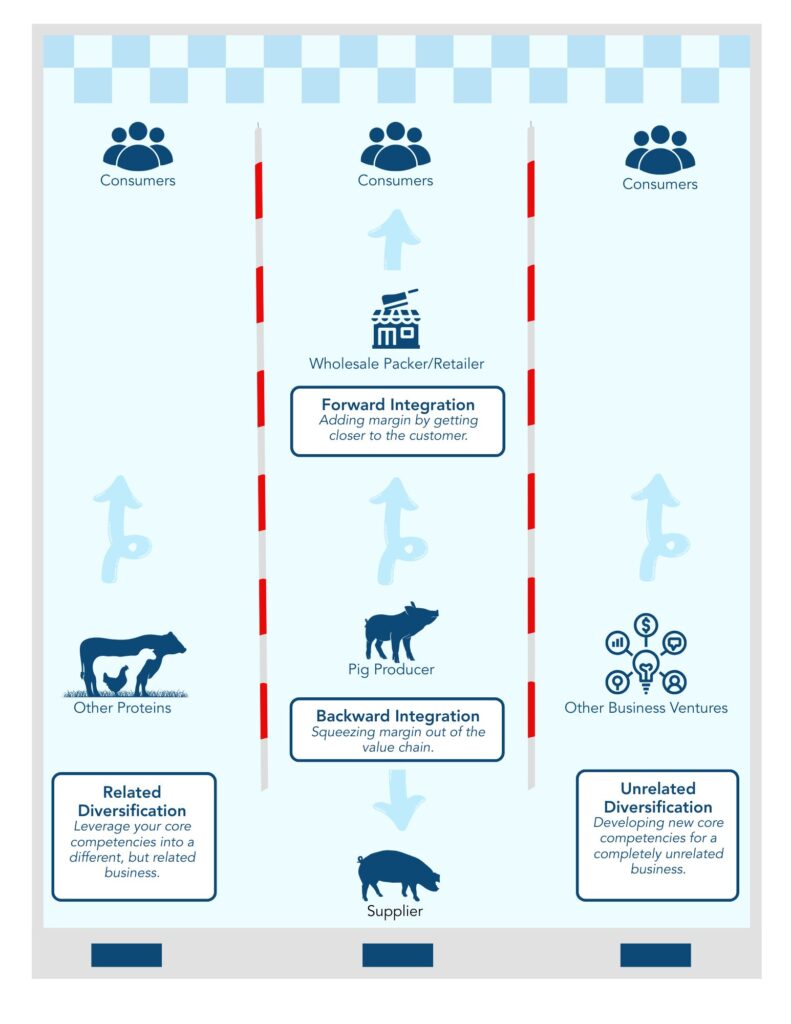

Doing the right things looks different to different managers. The first item on Warren Buffet’s investment strategy is to invest in what you understand. This approach exercises a healthy dose of common sense. Most farm managers are attracted to the things they know and understand. As a result, they often gravitate to opportunities that are close to their core business and are more easily understood. They are often motivated to either squeeze margin out of their value chain or add margin by getting closer to the customer. Either way, both approaches require capital investment. We call this vertical integration. It’s not a new idea in production agriculture. In fact, many of you have been doing it for years and have become quite proficient!

Some managers are more comfortable with being uncomfortable and see opportunities to swim in new lanes as their way to future proof their business. We call this diversification. To diversify, you can either choose to leverage your existing core competencies into a different but related business or you can choose to develop new core competencies for an unrelated business. Usually, the unrelated business investment is motivated by some business synergies. Either way, diversification generally requires more managerial courage and financial stability than vertical integration because you are swimming in a new lane as opposed to deeper water.

Here are some questions you should answer as you consider new opportunities:

- Will your decision to integrate or diversify improve your margins?

- Will your decision to integrate or diversify reduce your business risk?

- Will your decision to integrate or diversify improve your industry relevance? Is it a business capability that others would want to own?

- Will your decision to integrate or diversify allow you to do it at scale now and into the foreseeable future?

- Are you financially prepared to operate through the start-up phase of a decision to integrate or diversify?

- Do you currently have the expertise or experience on your team or have ability to acquire the talent to be successful?

- Is your decision to integrate or diversify today part of a larger plan?

As always, outside advice and perspective is extremely helpful as you consider your opportunities to vertically integrate or diversify. Build a network of people you trust who have the appropriate experience and expertise to help you critically evaluate your opportunities and plan for a successful vertical integration or diversification.