Over the past decade, ethanol plants have become increasingly efficient at squeezing every last bit of oil out of corn. This is good news for the ethanol industry. But this is a challenge for the DDGS by-product we rely on for swine diets. Historically, feeding DDGS up to 30% in grow-finish rations worked well—if the diet was balanced correctly. Today, that’s no longer the case. Swine nutritionists nationwide are sounding the alarm: modern DDGS aren’t delivering the same results. In some instances, they’re impacting growth and efficiency. Making informed, adaptable feeding decisions today is essential to future-proofing your pig herd and maintaining long-term performance.

What’s the Research Telling Us?

Kansas State University recently updated their distiller’s calculator and found that feeding up to 30% DDGS in the diet led to a 3–5% reduction in average daily gain (ADG) and poorer feed conversion (FG). Recent data from Pipestone Nutrition shows a similar gain and efficiency response when feeding only 10% DDGS in the diet. Several others have backed up these findings in their own trials, although the degree of impact seems to vary depending on DDGS source and diet formulation strategy. Bottom line – not all DDGS are created equal but it’s clear that their nutrient content is changing

Soybean Meal vs. DDGS – It’s a Balancing Act

Low soybean meal (SBM) prices in the last 6 months have driven more soybean meal into diets, reducing the inclusion of DDGS. Sounds like a win, right? But there’s a catch. When SBM increases beyond 30%, feed intake is also reduced. When high SBM is paired with increasing levels of DDGS, the reduction in intake and gain is two-fold (Giacomini et al., 2025). It’s all about balance and choosing your feed ingredients wisely.

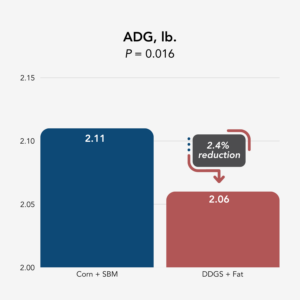

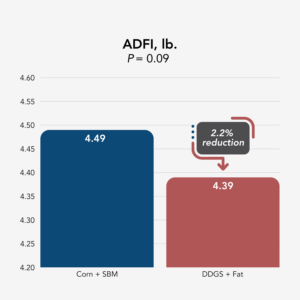

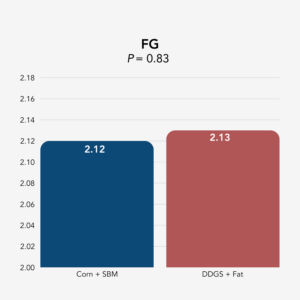

Pipestone Nutrition did a trial comparing two diets:

- Diet 1: Corn-soybean meal only, no DDGS or added fat

- Diet 2: Corn-soybean meal with 15% DDGS and 1% added fat

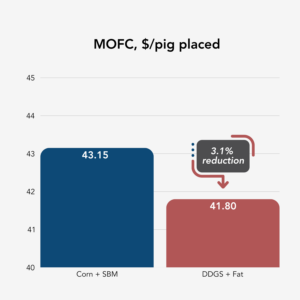

Diets were balanced with the same energy and cost per pound. The result? The DDGS-fed pigs ate 2% less feed and gained 2% less, even though feed efficiency stayed the same (Figure 1). This translated to a $0.82 per pig reduction in margin over feed cost (MOFC).

This tells us the diets were balanced correctly, but either the bulk density of the diet prevented pigs from eating more, or they didn’t like the taste of the DDGS.

What does this mean for you?

Distillers’ usage has dropped over the last 6 months. With DDGS pricing holding relatively flat as corn and SBM prices have lowered, many swine nutritionists have pulled DDGS out of the diet entirely. With hog markets holding strong, there’s even less reason to gamble on ingredients that might cost you in performance. Until DDGS quality is better understood or the commodity market shifts, DDGS will remain at lower inclusion rates in most swine diets. Most nutritionists opt to stick with proven corn-soybean meal-based diets. In the meantime, we aim to find out what has changed so that when commodity prices do increase, we can effectively feed DDGS to maximize profitability.

Figure 1. Effects of added fat in 15% DDGS diets on growth performance and economics in the early finisher period (MOFC was calculated using the following pricing: Corn = $0.072; SBM = $0.159; DDGS = $0.076; Fat = $0.638; Corn+SBM = $0.110/lb.; DDGS+Fat = $0.112/lb.; Pig Price = $1.05).