Ben Franklin is credited with saying, “An ounce of prevention is worth a pound of cure.” The proverb holds true today and is particularly relatable for pork producers.

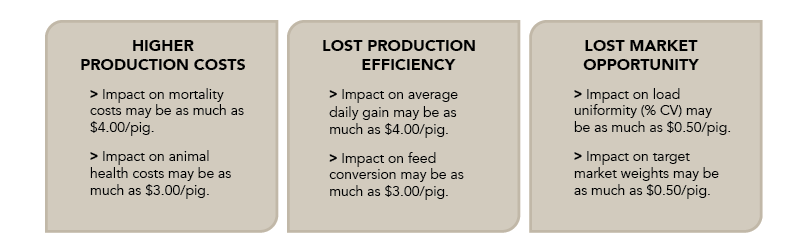

A disease event has the protentional to increase your production costs, reduce your production efficiency and increase your lost opportunity in the wean-to-finish phase of production. At Pipestone Business, we offer information systems like FarmStats and FarmBooks to help you measure and benchmark your production and financial performance respectively. Our team has studied that data and quantified the possible financial impact of disease events at the farm.

Based on these observations, the total cost of a disease challenge (like PRRS) may be as much as $15.00/pig. Obviously, the type of disease and severity will significantly influence the financial impact.

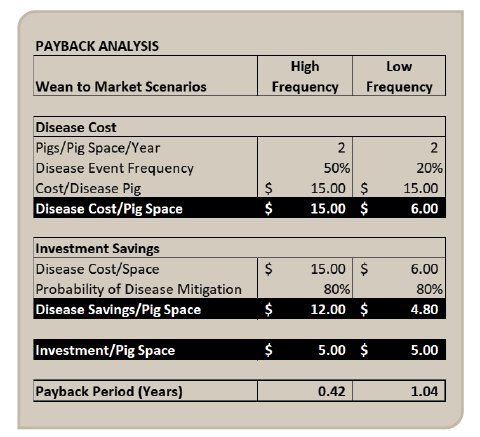

Measuring the frequency of your disease events can help you decide how much to invest to shut out disease. If history suggests that your farm will break with disease in 1 out of 2 pig groups (50% chance), you may be more motivated to invest in solving your health issues than when the frequency is only 1 out of 5 pig groups (20% chance).

If you know a frequent disease challenge continues to cost you $15.00 per pig, how much should you invest to attempt to fix the problem? You might start by calculating the payback period of your investment. The payback period is the number of years required to recover the original cash invested. In this situation, we will divided the capital invested per wean-to-finish pig space by the disease savings per space to determine the years required to return the original investment. The disease savings per space is the sum of the disease cost per space multiplied by the probability of disease mitigation. In other words, you are estimating your probability of success in shutting out disease once you make the investment.

In the wean-to-finish scenarios to the left, we make an investment of $5.00 per space to improve facilities, equipment, processes, and people. If we desire a one-year payback period, our investment would need to yield a $5.00 disease savings per space. If our health events are less frequent, it will take us longer to pay back our initial investment. In our payback analysis, we have only changed the disease frequency to illustrate its effect on the payback period.

In the wean-to-finish scenarios to the left, we make an investment of $5.00 per space to improve facilities, equipment, processes, and people. If we desire a one-year payback period, our investment would need to yield a $5.00 disease savings per space. If our health events are less frequent, it will take us longer to pay back our initial investment. In our payback analysis, we have only changed the disease frequency to illustrate its effect on the payback period.

We recommend you use the payback method to evaluate small projects or as an initial evaluation of larger projects. Major capital investments will require more sophisticated investment analyses. Your team at Pipestone Business can help to make sense of these difficult decisions.

Article by Jim Marzolf

Article by Jim Marzolf

Jim Marzolf is a Minnesota native who graduated from the University of Wisconsin with a B.S. in Animal Science; followed by an Executive MBA from Purdue University. Jim brought his experience in livestock production, finance, and business management to PIPESTONE in 2019 and serves as Executive Vice President of Pipestone Business.